BitRiver - Mining/Data Centre

BitRiver company provides maintenance and storage solution for setting mining farms. Location and price of the service are the main advantages. Such low expenditures improve cost-efficiency and mining income.

BitRiver company provides maintenance and storage solution for setting mining farms. Location and price of the service are the main advantages. Such low expenditures improve cost-efficiency and mining income.

The project management team consists of 5 core members. The CEO has over 8 years of experience in data center business. All members have a strong technical background and relevant work experience. Overall the team appears to be highly skilled and educated, the team has known each other for over 3 years and should show a frictionless work process.

CEO- Igor Runets

Education - Engineering & Computer Sciences

MBA From Stanford Graduate School of Business

Work experience

RTSoft. Principal engineer and project manager

Founded

“Servers.Global” data centre

“Fox Lab” hosting service

Deputy CEO; co-Founder - Sergey Runets

Education - Bs Economics

Work experience

15 years experience in Real Estate and Physical Security

CTO - Alex Pecherskiy

Education - Bs Engineering

Work experience

“Servers.Global”. COO

RTSoft. Principal Engineer

Head of Legal - Varun Gupta

Education - Joint & Dual Degree George Town University

Work experience

25+ years work experience

Bitfury. Chief Legal Officer

CTO - Andrey Salakhutdinov

Education - Bachelor of Science from Bratsk State Technical University

Work experience

15+ years Electrical engineering experience

Data centres are the core of Mining services: storage provision and communication, as well as maintaining a network for the growing number of networked devices. There is a growing demand for such hyper-scale deployments that are able to provide cost-effective and high capacity services.

POW Mining has been extremely profitable in 2017 due to the massive growth of the cryptocurrency industry. Although the largest cryptocurrency - Bitcoin is POW and does not show plans on moving to POS, the overall market tendency is searching more efficient alternatives to POW mining.

Ethereum the largest GPU mined coin has outlined, that in the next 2-3 years it will switch to POS.

Mining equipment fully depreciates in 1,5 years. Hence we can see POS as a medium-term risk. BitRiver payback period is calculated to around 18-20 months, hence one can be confident that the medium-term POS risks are fairly covered by the small payback period of Bitriver.

Most important factors for a facility used for hosting mining equipment are the cost of electricity + cost of temperature and humidity maintenance and the logistics for delivering mining equipment.

On average, mining facilities need to keep the temperatures at around 20-30 degrees Celsius, and a relative humidity reading of 45% to 55% so that the mining rigs do not shut down, melt or get short circuits.

Due to these factors, the most preferred mining regions are cool, dry and have cheap electricity.

BitRiver provides services for deploying servers and mining plants. By utilizing location capabilities to its full, BItRiver able to achieve low costs for deploying mining equipment, providing electricity and temperature control.

BitRIver plans to build a 200,000 sq. foot or 18,500 sq. meters data center, that is larger than 50% of existing and planned data centers in the US, as found from the AFCOM research. Such a large-scale facility allows utilizing economies of scale and connecting to a Hydro-powered energy station that is able to provide the center with over 1GW+ power. Which is approximately able to handle 600 000 s9 asic miners or a number of 100+ MW data centers.

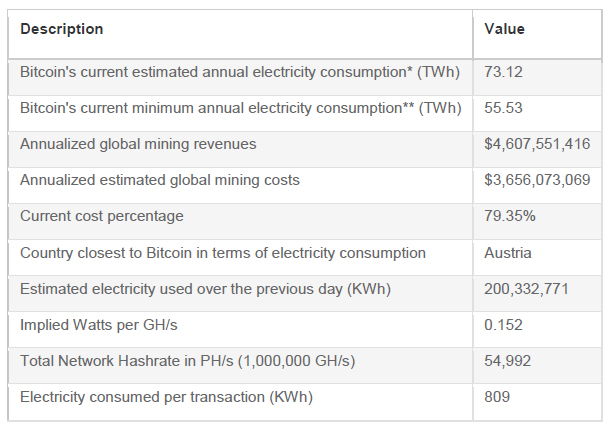

Bitcoin’s current annual electricity consumption equals to 73.12 TWh. What makes it the most important cost for any miner?

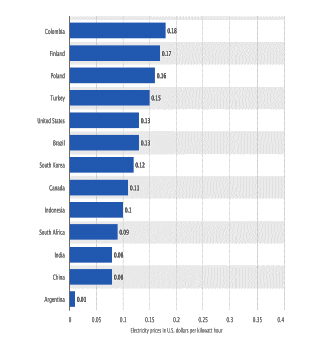

Due to direct connection to a Hydro-powered energy station and low prices per KW (0.02$). BitRiver will become one of the most competitive mining facilities in Russia and Asia.

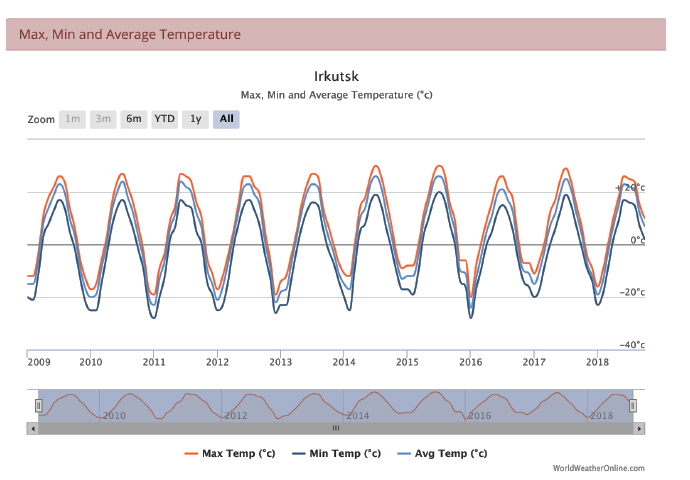

The Siberian cold climate allows saving on additional cooling systems. Many large-scale IT companies such as Facebook, Microsoft moving and constructing their data centers in cold areas such as Finland or Iceland. That allows using outside cold air to cool the infrastructure.

Irkutsk is a territory of -20(winter) to +20(summer) degrees Celsius temperature spawn and mild humidity. Due to the comfortable temperature conditions, BitRiver will be cutting many of its operational costs on maintaining the comfortable mining temperature. Such costs can add up to 20% of the total monthly expenditure.

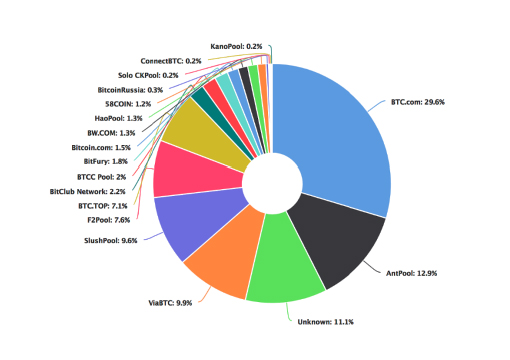

Irkutsk is close to China, the main exporter of mining equipment and the country with the largest Bitcoin hashrate.

BitRiver clients will experience the benefits of such location, as the costs of delivering mining equipment to BitRiver’s mining facility will be much lower, than to most of the world.

In addition, around 5% of miners, revenue influenced by network latency with the largest mining pools. Hence, distance from Chinese mining pool will affect a miner’s revenue. Irkutsk is relatively close to China consequently the miners will be around 5% more profitable than miners in the USA will.

Now of writing this report, it is uncertain how Parliament will regulate activities related to cryptocurrencies. Since regulatory institutes have only introduced a draft law that does not provide specifics of taxation of income obtained via cryptocurrencies (mining, trading or any other activity) it is hard to plan how it may affect profitability.

There have been several reports on that it is not unusual that mining equipment has been stolen from secured facilities. Even the use of CCTV and security alarm does not compensate the human error and fraudulent behavior form facility personnel. BtiRiver mitigates such risks by employing security services provided by National Guard of the Russian Federation that can provide physical presence within the facility.

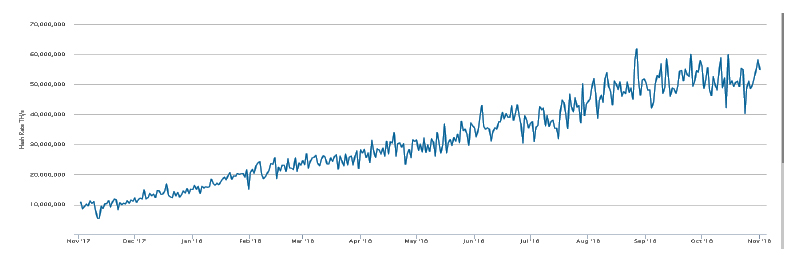

Even with the decrease in overall interest in the community, there is a steady growth of the bitcoin hash rate, which reduces the profitability. In addition, as it stated in the report by Morgan Stanley that bitcoin mining below its $8600 price won't let miner break even (assuming electricity costs about $0.03 per kW/h).

Minery.io

150 Megawatt

One of the largest data center providers

Hash chain

Cryptocurrency mining and blockchain solutions company focusing primarily on mining DASH in Vancouver.

Hydro Quebec

37,000 megawatts of installed electricity capacity With electricity costs at $0.0248 per kWh for data centers, and $0.0394 per kWh for miners, 50 per cent to 75 per cent lower than comparable areas in North America.

Georgia offers cheap electricity prices, alongside a friendly jurisdiction. Bitfury was one of the first to set up a mining facility in Georgia $0.08 per kWh

BlockBase

MEGABASE 1: 5MW

MEGABASE 2: 15MW

Hydro66

Hydro66, founded in 2014 is a pioneering, ultra-efficient, green-field colocation data center located in Boden

BitRiver has a presentation that covers all aspects of the business and outlines their advantages. Supporting documents provide confidence of legitimacy to run such facility.

The www.servers.global shows that BitRiver founders have extensive experience in managing data centers. Information found on LinkedIn shows that the team is experienced and has a sufficient & relevant education.

Overall, BitRiver has an experienced team, which can successfully build and maintain a data center facility. The Data market shows signs of continuing growth. In addition, Irkutsk has all the qualities to be an optimal location for a data center. BitRiver can provide high income for its equity investors since they are able to archive low costs only comparable to Chinese facilities.

Although we have outlined some risks, that the project is facing, the business model is realistic and with the right management, BitRiver can become a big player in the Mining market. The largest concern in concentration on mining.

BitRiver’s prices on electricity are cheaper than most of competitor’s, hence they will be attracting more clients. The payback period of 18-20 months seems realistic and very alluring. Bitmain representative visited the facility, BitMain is world largest ASIC chips designer, and as it stated by Bitmain visitors they have approved the facility.

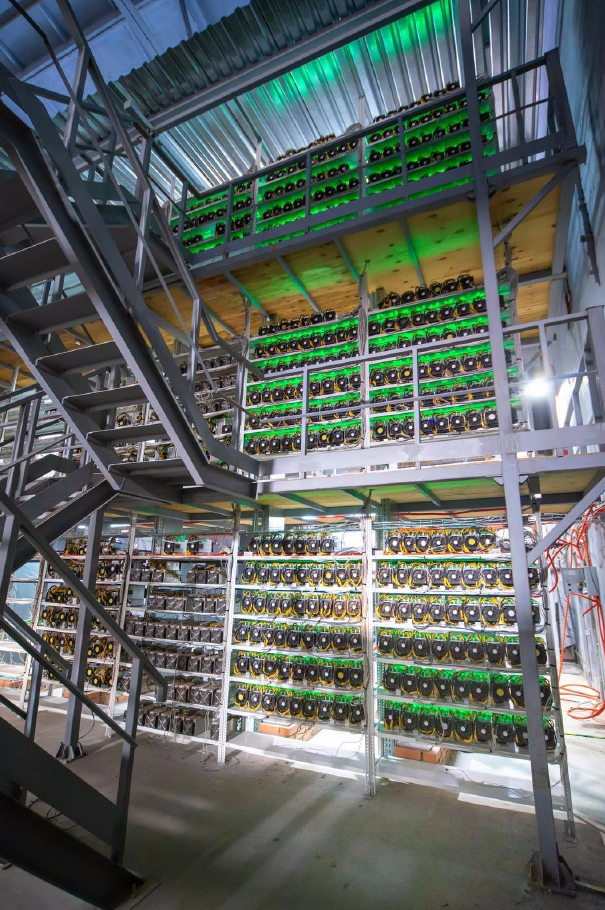

Photos representing the scale of the facility

Disclaimer

PALMINA Invest is not providing individually tailored investment advice and is not taking subscribers personal circumstances into consideration when discussing investments in venture capital projects and ICOs/STOs.

PALMINA Invest is a private investment firm and is not a broker-dealer or financial adviser. The analytical report is research and not an offer or advise to buy, hold, or sell any security.

PALMINA Invest and/or any companies affiliated with PALMINA Invest are not responsible for any gains or losses that result from the opinions expressed herein.

PALMINA Invest makes no representation as to the completeness, accuracy, or timeliness of the VC projects material provided and all materials are subject to change without notice.

The VC projects and ICO discussed herein have not been reviewed by the securities and exchange commission or any state securities regulatory authority. Furthermore, the foregoing authorities have not confirmed the accuracy or determined the adequacy of the VC projects documents. Any representation to the contrary is a criminal offence.

The VC projects identified herein may constitute securities pursuant to federal and state securities laws and may not be appropriate for, or offered to, investors residing in the United States. In making an investment decision, investors must rely on their own examination of the person or entity issuing the ICO and the terms of the offering, including the merits and risks involved.

Investment in VC and ICOs involves a high degree of risk and should be considered only by persons who can afford to sustain a loss of their entire investment. Investors in VC and ICOs should consult their financial adviser before investing in VC. The securities and exchange commission has warned investors residing in the united states that ICOS may constitute securities, and by investing in ICOs, investors may be purchasing unregistered securities offerings. Investors who invest in VC projects and ICOs may be unable to recover any losses sustained in the event of fraud or theft.