Thaler.One

Global commercial real estate marketplace, which use blockchain as a transport for assets.

Global commercial real estate marketplace, which use blockchain as a transport for assets.

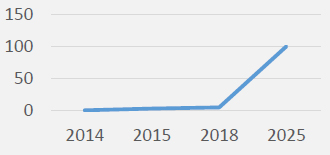

As predicted by The World Bank global real estate crowd funding market can reach $100b by 2025